Personal Loan vs 0% Instalment Plan: Bank Financing vs Credit Card Flexibility for Solar in Malaysia

Last updated: 11 Nov 2025

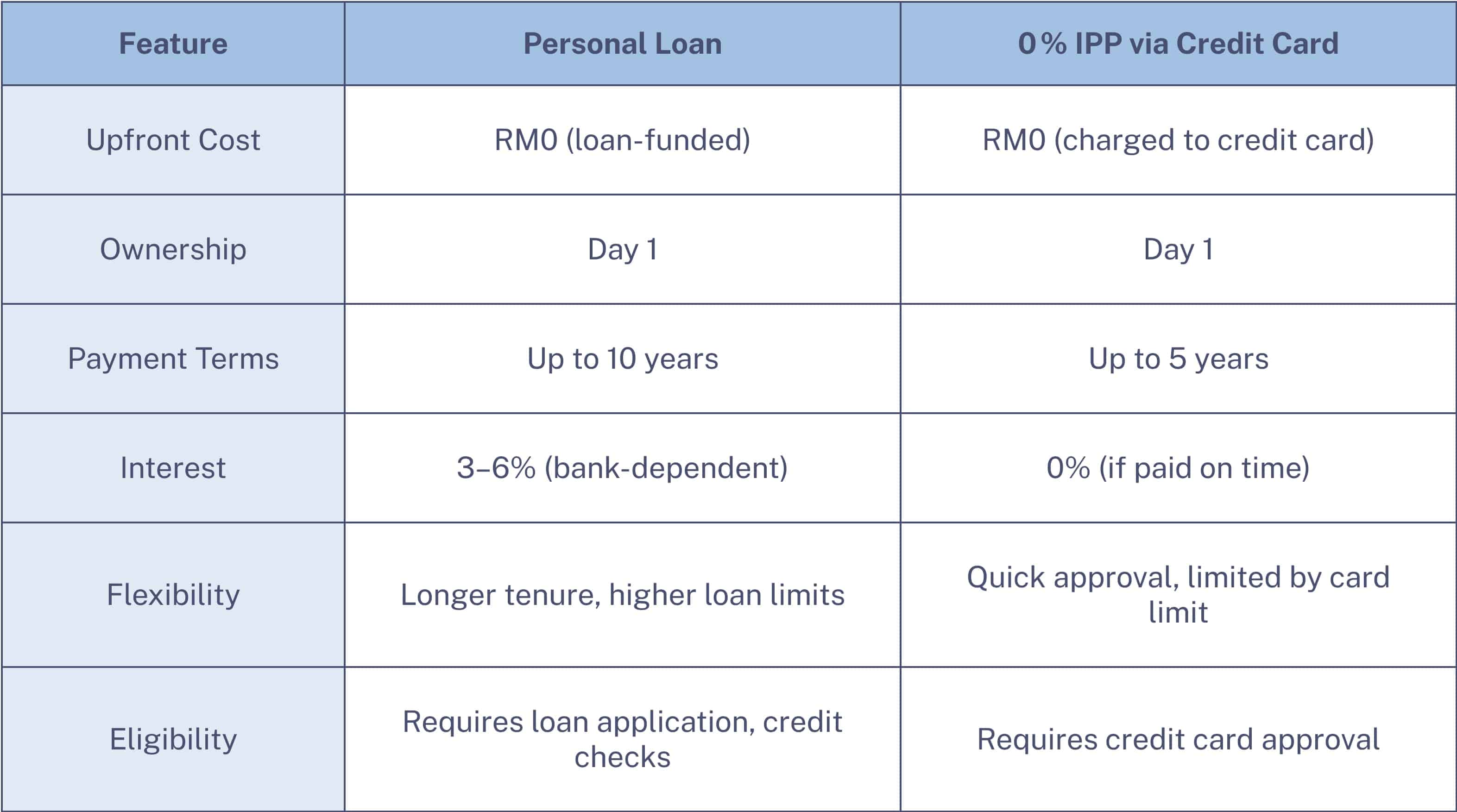

Weigh the pros and cons of using a personal loan versus a 0% Instalment Plan to finance your solar system, and see which option best suits your financial lifestyle.

Financing your solar system doesn’t have to be complicated, but choosing the right method can make a big difference to your monthly budget and long-term savings.

- Personal Loans, where banks provide structured financing with fixed interest rates.

- 0% Credit Card Instalment Plans (IPP), where you split payments into interest-free monthly instalments.

Both get you immediate ownership of your solar system, but each has unique pros and cons. Let’s compare them.

What Is a Personal Loan for Solar?

- Payment Terms: Up to 10 years (depending on bank).

- Ownership: Immediate – the system is yours from day one.

- Interest: Typically 3–6% p.a., depending on credit score and loan tenure.

- Eligibility: Subject to bank approval and credit checks.

- Extras: Warranty and free first-year maintenance included.

What Is a 0% Instalment Plan (IPP)?

- Upfront Cost: RM0 upfront with eligible banks.

- Payment Term: Spread payments over 12–60 months (up to 5 years).

- Ownership: Immediate.

- Interest: None – provided you pay within the instalment period.

- Eligibility: Requires participating bank credit card.

- Extras: Warranty and free first-year maintenance included.

Let's Compare

Who Should Choose Personal Loan?

- Homeowners financing larger solar systems (above RM 40,000-50,000).

- Families who need a longer repayment term (up to 10 years).

- Those who don't want to tie up their credit card limits.

Who Should Choose 0% Instalment Plan (IPP)?

- Homeowners with credit cards and sufficient limits.

- Families who want interest-free financing with predictable monthly instalments.

- Buyers installing small to medium systems where total cost fits within card limit.

Real-Life Example

Personal Loan (10 years, 4% interest):

≈RM350/month (approx.) – subject to bank approval

0% IPP (60 months):

RM500/month, ROI in 5 years.

Both options give you solar savings immediately, but the choice depends on whether you prioritise longer tenure flexibility with interest or interest-free payments.

Conclusions

Thanks to flexible financing solutions, going solar is now easier than ever to get started. With the right financing, you can unlock the benefits of solar – lower electricity bills, long-term savings, and a greener future – without carrying the weight of heavy upfront costs.

Ready to compare your options? Contact us today!